Table of Contents

showSpending too much on recruitment, payroll or global HR?

We help you find the Best Providers at the lowest cost.

Payroll outsourcing means contracting a professional services company to process and manage your employee payroll. I analyzed and graded 78 payroll outsourcing services to come up with the top 13 providers. My pick for No. 1 Payroll Company in 2024 is Horizons.

Top 13 Payroll Outsourcing Services

Of the 78 payroll providers we tested, these are the 13 best:

- Horizons: Best Payroll Outsourcing Company

- Rippling: Best for Flexibility

- Access Financial: Best for Recruiters

- ADP Run: Best Payroll Outsourcing for Small Businesses

- Square: Best for Contractor Payment

- Zenefits: Best for Payroll Analytics

- Paychex Flex: Best Payroll Outsourcing for Startups

- Paycor: Best Payroll Outsourcing for Large Companies

- Gusto Payroll: Best Payroll Outsourcing for US Companies

- Deluxe: Best for Add-On Service

- Wave Payroll: Best for Integrations

- IMC: Best Payroll Provider for UAE, Singapore & India Companies

- Onpay: Best Payroll Platform

How We Compare Payroll Outsourcing Companies

My review of the top payroll outsourcing companies provides something for everyone:

- A la carte and add-on options for companies that are scaling at pace

- Budget plans for smaller operators

- International payroll capabilities for global companies and more.

The top 13 payroll outsourcing companies cover everything a business may seek in a payroll provider. As always, be sure your payroll company operates in the same regions as your business and employees, offers the tools you need, and provides the right coverage to keep your employees happy and safe.

Our reviews are based on an assessment of dozens of payroll outsourcing companies, looking at their customer reviews, service offerings, and reputation within the industry.

Best Overall Payroll Outsourcing Company

Horizons

Horizons is a full-service global payroll, recruitment, and Employer of Record (EOR) company with a presence in 180+ countries.

Through their payroll outsourcing services, you can ensure that your international employees are paid compliantly, in their own currency, in whichever country they are based.

Horizons Pros

Compliant payroll in 180+ countries

Market-leading SaaS platform

Full service employment solutions, including EOR and recruitment, as well as payroll.

Horizons Cons

Fewer integrations than some other providers

Our Verdict

Horizons is arguably the world’s leading global payroll solution, and services can easily be scaled up or down as business needs require. The key benefit of working with Horizons is that they can manage all your employment and HR processes. From recruitment, to hiring, to payroll, to visas — Horizons has you covered.

Best for Flexibility

Rippling

Rippling is a relative newcomer to the payroll outsourcing market, but that doesn’t mean it’s short on features and options. Its offerings have shot it right to the top of our list of payroll outsourcing companies.

The payroll outsourcing service includes processing for every state in the US and international payroll processing; international, federal, state, and local tax filing; workers comp, garnishing service; W-2, W4, 1099, and international form filing; and General Ledger syncing.

A la carte add-ons include time tracking with kiosk and mobile clock-in, benefits administration, commuter benefits, ACA and COBRA administration, applicant tracking, compliance courses, employee surveys with trend analysis, HR help desk support, national and global PEO services, employee app management, employee device management, device inventory management, corporate card management, international expense management, and more on the way.

With these options, Rippling becomes an all-in-one HR and enterprise solution. Rippling also provides setup assistance to ensure the software is configured to the needs of each business.

With all this in mind, it’s easy to see why Rippling made it to our list of payroll outsourcing companies.

Rippling Pros

Extensive integrations

Tiered pricing, so customers only pay for what they need

Ease of scaling to PEO and EOR solutions

Rippling Cons

Paying by component means costs add up

Not all service pricing listed on site

Our Verdict

Rippling is a leading payroll service with extensive integrations to limit the number of HR and payroll apps and subscriptions you require. Check out our 2024 breakdown of Rippling’s product offering to learn more.

Best for Recruiters

Access Financial

Access Financial is an international provider of outsourced payroll, contractor management, and umbrella services. Access offers customized and compliant solutions to corporate customers, recruitment agencies, and independent contractors.

Access Financial Pros

Global payroll in 100+ countries

Contractor and umbrella company services

Special relationship with recruitment companies

Access Financial Cons

Does not yet have coverage in every location

Our Verdict

Access Financial is not just an international payroll company, but an international umbrella company. Something distinctive about the Access approach is that they work directly with recruitment companies, and not just clients and workers.

Access is our pick for the best payroll company for recruiters.

Best for Small Businesses

ADP Run

ADP Run is one of the best payroll outsourcing companies specially designed for small businesses. The service comes from ADP, the world’s largest payroll outsourcing company. The service offers four packages, with the basic option including W-2 and 1099 form filling, tax filing, and a General Ledger (GL) interface. More advanced packages include State Unemployment Insurance (SUI) management, garnishment services, ZipRecruiter, background checks, HR training, a compliance database, onboarding, training, legal assistance, and more. Beyond that, ADP Run clients can always upgrade to the main ADP service for more enterprise and PEO tools.

ADP Run

ADP Run Pros

A system that is simple to use

Automated tax filing and reporting

Add-on marketing and legal services available

Flexible and custom plans available

ADP Run Cons

Contractor payroll processing and benefits administration require add-ons

Tax filing incurs add-on charge

Our Verdict

ADP Run was developed with small businesses (less than 50 employees) in mind. Its packages start with basic payroll outsourcing but upgrade options support companies with growing needs. For small companies looking to grow quickly, especially those planning on outsourcing further HR capabilities and signing up for PEO services in the future, ADP Run is a sound choice.

Best for Contractor Payments

Square

Square Payroll is unique in offering a plan with no monthly base fee (something other payroll outsourcing companies may follow in the future). The contractor plan charges a small monthly charge for each contractor payroll processed as a basic, no-frills plan. The standard Square Payroll plan will also include regular employees; however, this comes with a monthly fee.

An advantage of Square is that Square Payroll will work with all of Square’s other products, such as POS and online store solutions, banking management, staff scheduling, and more.

Square Pros

Form 1099 filing included, with automated end-or-year filing

Contractor plans have no monthly base fee

Square Cons

One option only for plans

Few HR tools

Our verdict

For businesses that mainly employ contractors or freelancers, Square Payroll can take the headache out of payroll quickly and inexpensively. It also provides an advantage for business owners looking for retail and POS solutions; all can be integrated easily within the Square ecosystem. This may not be the best product for those looking for a payroll outsourcing company that can be upgraded into a full HR or PEO solution.

Square is our pick as the best payroll company for contractors.

Best for Payroll Analytics

Zenefits (TriNet Zenefits)

The Zenefits Payroll service (a solution from TriNet Zenefits) offers a range of payroll features. These features create a flexible system that can be easily upgraded as the company grows. The basic Zenefits plan includes automatic federal and state tax filing, automatic compliance, payroll reporting, automated onboarding, time off tracking, integration with other apps, analytics dashboards, employee management, scheduling, and a mobile app. Upgrades add people analytics, compensation management, performance management, employee engagement surveys, People Hub (a communication tool for employees and management), advisory services, and recruiting.

Zenefits Pros

Onboarding and management tools

Simple, user-friendly interface

Powerful Business Intelligence (BI) reporting

Zenefits Cons

Customer service complaints from online reviewers, occasional long waits

Not all admin tools available on mobile app.

Our verdict

The basic Zenefits Payroll plan offers plenty of features, such as tax filing and compliance, at a reasonable monthly price. This package will be attractive and affordable to many businesses and integrates well with other software tools. However, the system does not support contractors or international payroll.

For its extensive analytics and reporting functionality, Zenefits is my choice as the best for payroll analytics.

For larger employers who plan on upgrading to a full HR or PEO solution, it is straightforward to move to the complete TriNet PEO solution (Read more about TriNet in our 2023 TriNet review)

Best for Startups

Paychex

Paychex is one of the largest payroll outsourcing companies, currently processing payroll for 1 in 12 private sector employees in the United States.

The Paychex Flex service is a stripped-down, upgradeable option for small businesses that want to start with basic payroll outsourcing services and add additional tools when needed. Paychex Flex’s basic service includes payroll processing for employees and contractors, garnishment service, and an employee self-service portal allowing staff to view their own pay and tax info. Other HR services are also available.

However, the service does not fill and file W-2 and 1099 forms without an added fee. Other paid add-ons include time, attendance, and mileage tracking through the Flex Time feature, a self-service onboarding portal, and background checks with the Flex Pro plan.

Paychex Flex Pros

Easy-to use system

Paycheck garnishing service at no extra charge

Flexible and custom plans available

Contractor payment processing included

Paychex Flex Cons

Payroll tax, W-2, and from 1099 filing incurs extra charge

Our verdict

Paychex Flex will be a good choice for small companies looking for payroll outsourcing for employees and contractors and little else. As needs grow, businesses can upgrade with Flex Time, Flex Pro, or the full Paychex service. For those who need tax filing and form filling as part of their basic package, though, other services may be more economical.

The ability to quickly scale up the payroll package means Paychex Flex is my payroll outsourcing pick for startups. Of all the payroll outsourcing companies out there, this one won’t let you down.

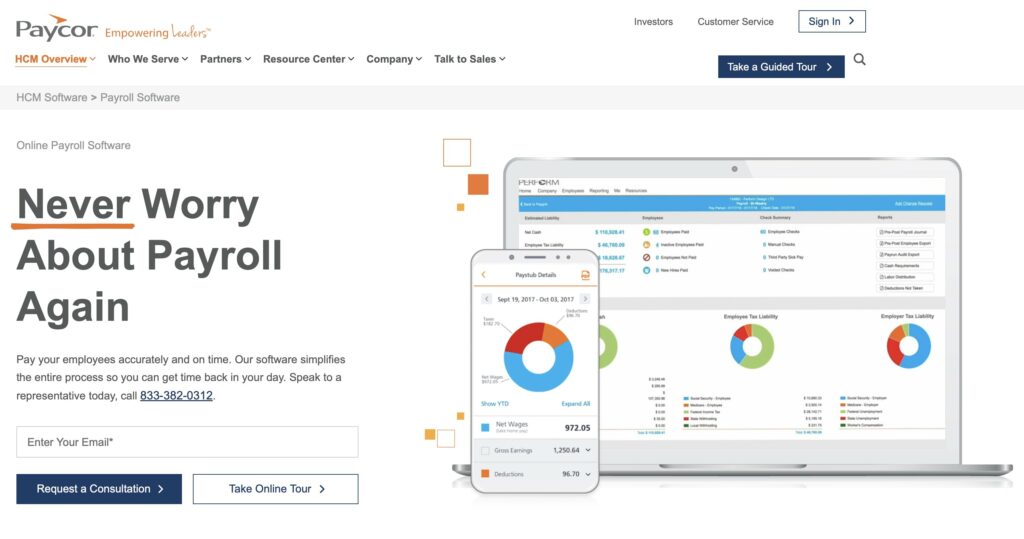

Best for Large Companies

Paycor

While Paycor’s per-employee fees are similar to those of many competitors, their monthly base fees are higher.

The service included, however, also meets a high standard. The basic plan contains automated payroll, unlimited payroll runs, a self-serve portal for employees, compliance support, and automated tax filing. Upgrade plans add onboarding support, HR support, analytics, 401(k) administration, and garnishment service.

Paycor Pros

Simple system

Performance reviews, recruitment, and other HR tools included

Paycor Cons

Contractor payroll not included

Monthly fees and charges per employee high

Employee portal needs upgrading

Our verdict

For companies with more staff, the Paycor features may be worth the higher base fee, as opposed to paying higher per-employee fees for add-ons such as tax filing and compliance support. This may not be the best option for businesses with just a few employees who wish to outsource payroll processing only or those looking for an option to upgrade to full PEO service.

Paycor is my choice as the best payroll company for large enterprises.

Best for US Companies

Gusto Payroll

Gusto offers competitive features with its basic packages, such as employer and contractor payroll (a contractor-only option with no basic monthly fee) and tax filing. What sets it apart are the benefits administration and time tracking services included in the basic package.

Benefits administration includes the option to purchase employee insurance packages through the platform, commuter benefits administration, as well as retirement, saving, housing, and wellness support.

To learn more about Gusto’s offerings, check out our detailed 2024 Gusto review.

Gusto Pros

Simple system for both employees and independent contractors

Automated tax filing and guidelines on regulatory compliance

Free checking, savings accounts, and advances on employee paychecks

Health insurance add-on available in some states

Unlimited payroll runs

Gusto Cons

International payments not supported

Accounts receivable and invoicing are not included

Charge per employee gets high for large employers

Customer service not available on weekends

Our verdict

The Gusto contractor-only option gives small organizations working with teams of freelancers a simple way of handling payroll. At the same time, the basic package for employees and contractors offers many bonus features that are not available from other competitors for the same price.

Gusto is an excellent solution for US-based companies looking for a simple payroll outsourcing solution. However, it may not have the features and add-ons needed by international employers or those looking for a complete HR or PEO solution. Note, however, that Gusto recently announced a collaboration with Remote which will enable full international support.

Best for Add-on Services

Deluxe

In addition to payroll outsourcing, Deluxe offers software for business, payment processing, and marketing solutions. This makes it one of the leading payroll outsourcing companies out there.

The Deluxe payroll outsourcing system includes competitive features such as a simple and intuitive dashboard, tax payment processing and penalty protection, custom reporting, and integration with accounting software and POS systems.

Deluxe Pros

Marketing and other services available on the same platform

Ability to combine services with other payroll providers

Simple, user-friendly, system

Deluxe Cons

Contractor payroll incurs an additional charge

No free trial available

Our verdict

Deluxe payroll outsourcing may be very attractive to businesses eyeing Deluxe’s other marketing, payment processing, and business software offerings. However, Deluxe’s pricing will be less competitive than other options for those looking for a simple payroll solution.

For more information on how to choose the right set of payroll services for your company, check out our guide, How to Outsource Your Payroll – Step by Step Guide.

Best for Integrations

Wave Payroll

Like some other systems, Wave Payroll includes payroll processing for contractors. However, Wave only charges a monthly fee for the contractors paid in a given period. If a company has ten contractors or vendors on call but only used two monthly, they will only be charged for two contractor payrolls. This is a trendy option among payroll outsourcing companies.

Wave will pay and file taxes in 14 states, but the monthly base fee is reduced for clients operating outside of these areas. Payroll is not fully automated, and there is no mobile app. However, the system is simple to use, and pricing is competitive. The Wave ecosystem also includes other business management software products that integrate well with Wave Payroll.

Wave Payroll Pros

Invoicing and accounting included with payroll platform

Simple interface for both employees and employers

Contractor payroll services included

Wave Payroll Cons

Benefits administration not included

Automated payroll taxes not available in many states

Our verdict

For businesses that use many different contractors but do not necessarily pay each of them every month, the flexibility of Wave Payroll will bring significant savings on their monthly fees. Those operating in the states covered will get the bonus of tax filing for a slightly higher base monthly fee. Companies that already use or plan on using Wave’s other software solutions will find the payroll outsourcing feature a simple and cost-effective addition to their business management suite.

For its extensive connectivity with other software and apps, Wave is our pick as the best payroll company for integrations.

Best Payroll Service Provider for UAE, Singapore, and India Companies

IMC

IMC is one of the largest payroll service providers for large companies, multinational corporations, small and medium-sized enterprises, high-net-worth individuals, family-owned businesses, and start-ups in the UAE, Singapore, and India. Choose IMC as your partner to streamline operations and let them elevate your business with comprehensive support. IMC stands out among all the payroll outsourcing companies targeting these wealthy companies.

IMC is also a leading cross-border advisory firm and a Member Firm of Andersen Global in the United Arab Emirates, Singapore, and India. They provide hassle-free payroll services for your business success.

To learn more about IMC’s offerings in Dubai, check out their Payroll Services.

IMC Pros

Global payroll outsourcing

Seamless Integration

Cost Effective

Saves time & resources

Navigating laws and regulations

Mitigating errors & penalties

Keeping pace with the latest technology

Overcoming language and cultural barriers

Delivering transformative HR and payroll solutions

IMC Cons

Customer service is not available on weekends

No free trial available

Our verdict

IMC is a standout global payroll provider, providing international payroll solutions and cross-border advisory services to support every aspect of international expansion.

While IMC supports payroll in any location, it has deep expertise in international financing and outsourcing hubs. For this reason, IMC is the best payroll provider for UAE, Singapore, and Indian companies.

Best Payroll Platform

OnPay

OnPay is a user-friendly HR and payroll platform designed to streamline payroll management and HR processes. Its target market is small to medium-sized businesses (SMBs) and is competitively priced. What makes OnPay stand out among payroll outsourcing companies is its user-friendly, simple payroll management platform and additional HR features.

OnPay Pros

A user-friendly and intuitive interface and platform

Clear and transparent-pricing

Added HR functionality, including an employee self-service portal and time-tracking

OnPay Cons

Fewer integrations than some other providers

Does not connect to a full PEO solution for customers who seek to transition to that service

Our verdict

OnPay is an intelligent payroll outsourcing for small to mid-sized businesses after a cost-effective and user-friendly payroll platform. With a product focus, OnPay is an excellent option for companies after a solid payroll-only solution. Read more in our 2024 OnPay review.

The Best Payroll Outsourcing Companies in 2024 — Our Take

Choosing the right payroll company for your payroll outsourcing services needs means paying attention to prices, additional services offered, customer reputation, and whether the company services businesses of your size and industry.

With the various payroll companies we have reviewed, you will likely find a solution that is well-suited to your business.

FAQ

The best payroll company for your business depends on the size of your business, the industry, and which services you seek. While we have judged Horizons to be the best-outsourced payroll solution overall, it may not be the right choice for every business. For example, some smaller companies may find engaging a payroll provider with more limited options more cost-effective.

A payroll company specializes in processing payroll for client companies in the US or internationally. A Professional Employer Organization (PEO) acts as the co-employer of workers and takes care of benefits, HR compliance, and payroll.

Some payroll companies, including Horizons, Rippling, TriNet, ADP, and Paychex, also offer PEO solutions.

You can learn more about PEO solutions in our Top Ten Guide to Professional Employer Organizations.

When selecting a payroll outsourcing company, consider their experience, reliability, and the range of services they offer. Ensure they can handle your specific payroll needs, offer scalable solutions, and provide excellent customer service. Checking reviews and seeking recommendations can also be helpful.

A payroll outsourcing service should offer comprehensive payroll management, including pay calculation, tax withholdings, compliance management, and reporting. They should also provide a secure and user-friendly platform for managing payroll data and be available to answer any questions or concerns you might have.