Table of Contents

showSpending too much on recruitment, payroll or global HR?

We help you find the Best Providers at the lowest cost.

A PEO (Professional Employer Organization) is an outsourcing firm that provides holistic payroll and benefits solutions for small and mid-size businesses. By entering into a co-employment arrangement with an employer, a PEO can manage various functions such as payroll, benefits, HR, tax administration, and regulatory compliance, allowing businesses to focus on their core operations. This relationship can help companies to offer better employee benefits and reduce administrative burdens.

Key Takeaways

- A Professional Employer Organization (PEO) is a comprehensive payroll and benefits service provider that handles payroll processing, payroll tax filing, benefits enrollment and administration, and, often, limited HR compliance support for employers.

- The concept of PEO is similar to the concept of EOR (‘Employer of Record’), though some key differences exist. ‘EOR’ is commonly used with companies wishing to hire internationally.

- There are pros and cons to engaging a PEO: A PEO may reduce the costs associated with group benefits, but, depending on the solution and how your organization is structured, switching to a PEO may increase admin costs for your organization. PEOs streamline billing by serving as your one point of contact for all things payroll and benefits. Employees appreciate PEOs because they gain access to richer benefits, including excellent ancillary benefits and Employee Assistance Programs (EAP). Depending on the PEO; however, some aspects of the employee experience may be compromised by poor user interfaces, integration limitations, impersonal support, and inflexible admin processes.

What is a PEO?

A Professional Employer Organization (PEO) is a third-party service provider that assumes partial responsibility for administering payroll and benefits for employers with domestic employees. PEOs “hire” your employees for payroll, payroll tax, and group benefits purposes. Your organization remains the employer for purposes of day-to-day supervision and employment law compliance. This shared employment responsibility is known as a co-employment relationship. Many PEOs also offer HR support, along with compliance resources for employers, managers, and HR system administrators.

There is no single list of services that all PEOs provide. The services provided by a PEO will depend on the contract they sign with their corporate client, their chosen business model, and any laws and regulations that apply to that PEO under state or federal law. The functionality and seamlessness of PEOs’ online HR, Payroll, and Benefits Enrollment systems also vary greatly from one PEO to the next. It’s important to come to your talks with prospective PEO vendors prepared with the right questions and a list of your company’s top priorities.

How does a PEO work?

Which companies need a PEO?

PEOs solve several common business problems and can improve your company’s operations in a number of ways. Your organization may be ready to transition to a PEO if you’re looking to improve:

- Hiring of US Employees: Offering enhanced benefits allows your company to better compete in a tight US labor market. Some PEOs’ online systems also include applicant tracking systems (ATS), which streamline hiring via automated workflows.

- Billing and Vendor Management: By moving to a PEO, you consolidate billing for payroll, benefits, and other HR services under one vendor. This saves your AP team time, allowing them to focus on other value-add initiatives.

- Access to Resources and Support: Many PEOs do a good job of aggregating resources such as employment law posters, notices, and handouts in one system. They also usually offer employer and employee-facing FAQs and customer support.

A PEO may be a great fit if your company is looking to attract and retain US W2 employees without significantly increasing your team’s administrative burden. However, most PEOs won’t allow clients to pay their entire workforce (including contractors and global team members) in one central HR system. Employers with global, remote, and dispersed teams that include conventional employees and self-employed contractors may want to consider Employer of Record (ERO) services in addition to or in place of a PEO.

How does a PEO relate to an Employer of Record (EOR)?

A closely related concept to a PEO is an ‘Employer of Record.’ An Employer of Record (EOR) is an entity with the legal responsibilities of the employer. Like a PEO, the EOR is the employer who withholds income taxes and administers payroll taxes and employee benefits. The key differentiator is that an ERO assumes additional liability on behalf of their customers by administering employment contracts and ensuring compliance with local labor laws. For example, an EOR may be recognized as the legal employer for collective bargaining purposes. In short, a PEO is a co-employer, while an ERO is the actual employer “on paper”.

Both PEOs and EROs help companies improve their offerings to attract talent. While PEOs usually support companies with domestic hires or hires in one particular country, EROs tend to be used to hire abroad or in multiple countries. Employers primarily leverage EROs to hire employees in other jurisdictions without having to create local business entities. This allows global employers to test out new markets and to build teams in those markets quickly. Smaller companies especially benefit from the ERO-leveled playing field since they can offer local employee benefits. Businesses also use EROs to contribute via payroll taxes to local statutory benefits like pension, reemployment, workers’ compensation, and paid leave entitlements, where applicable.

Some EROs outsource payroll processing and other services to separate, local companies, while other EROs form local entities to manage payroll, taxes, and statutory benefits administration directly in each country. The specific services provided and whether or not they are outsourced or “white-labeled” are typically covered in the ERO’s Master Services Agreement.

The history of PEO and its origin in employee leasing

Before the 1990s, the terms PEO and EOR were not commonly used. However, a related concept known as ’employee leasing’ was popular starting in the early 1970s. When this practice first began, it was not widely publicized or well-known, but by 1993, according to the New York State Inter-Agency Task Force on Employee Leasing, there were 15,000 leasing companies in the United States.

In its original form, employee leasing proceeded as follows: A regular company officially terminated its existing employees and arranged for an employee leasing company to hire those employees. The original company then ‘leased back’ those employees onto their worksite.

For the original company (the ‘client company’), this meant saving time and money by transferring the most onerous employment responsibilities to another party, including responsibility for health insurance, 401k contributions, and workers’ compensation. From the employee’s perspective, it would have looked as though little had changed, even though the underlying legal relationships had altered significantly.

In some cases, employee leasing led to:

- Workers’ compensation premium fraud. Due to employee leasing companies’ lower health and safety risk profile, artificially low workers’ compensation premiums could be paid. Those premiums did not reflect the risk for workers on the worksite. This has also been referred to as the ‘Workers Compensation Shuffle.’

- Discrimination in pension plans. Client companies used employee leasing to avoid providing their workforce with the pension plans they would otherwise be entitled to under the Revenue Act of 1942. Employers using pension plans to offset their tax bills were prohibited from discriminating between employees with pension plans (I.e., the executives could not be generous to themselves and leave the rank-and-file employees with nothing). As a workaround, some companies used employee leasing to claim that some workers were ‘not their employees’ and, therefore, could be paid fewer benefits. If the employee leasing company went insolvent/bankrupt, employees could be deprived of their entitlements.

- For an in-depth look at the origins of PEOs and early employee leasing fraud, see this recent article in the Berkeley Business Law Journal.

What is a certified Professional Employer Organization?

In 2014, two new sections of the IRS Code were introduced to establish a voluntary certification program for PEOs. A certified Professional Employer Organization (CPEO) is a U.S.-based business entity that has met a set of requirements set out by the IRS.

Once certified by the IRS, the certified CPEO will be treated as the sole employer of a client’s workforce. This benefits client companies because they will no longer be liable for federal employment taxes as a ‘co-employer’ of workers.

To become certified, a PEO must:

- Have a physical business location within the United States,

- Have a history of financial responsibility and organizational integrity, and

- Be managed by individuals with knowledge or experience regarding federal and state employment tax compliance and related business practices.

Once certified, the CPEO must post an annual bond of between $50,000 and $1,000,000, guaranteeing payment of employment taxes.

Less than seven percent of PEOs in the U.S. are certified by the IRS.

How do PEOs operate?

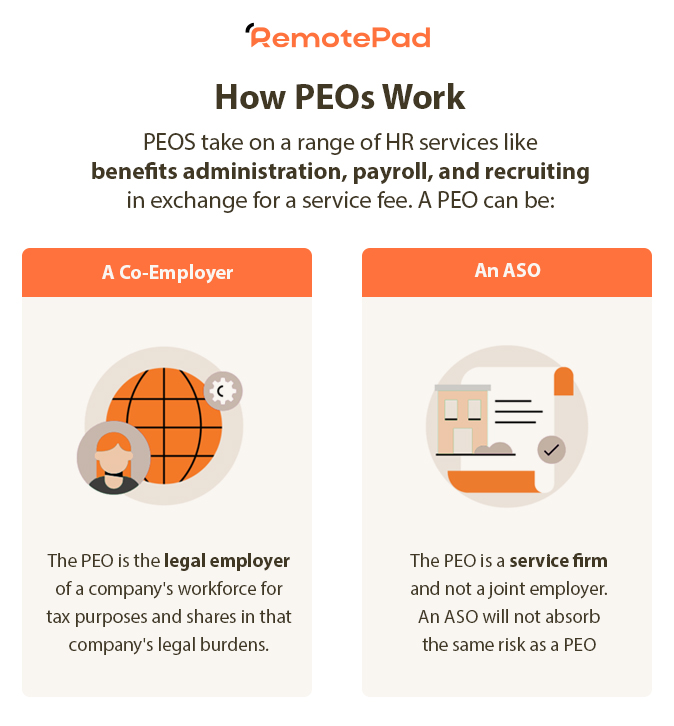

How a PEO works depends on the chosen business model of the PEO, the engagement agreement between the client company and the PEO, and the laws and regulations that apply in a given state or country.

Generally speaking, the PEO and client company will agree that the PEO will provide the following services:

- Payroll processing.

- Benefits administration, including pension contributions, workers’ compensation, and other employment-related insurance.

- Employment tax compliance. This includes employee income tax withholding, payroll tax administration, and managing state unemployment taxes.

- Any other HR functions as agreed.

Once a business partners with a PEO, the PEO and client company generally become co-employers of the business’s employees. This means that both the client and company share employment responsibilities: The client company is usually responsible for the day-to-day direction of the employee, while the PEO is responsible for the administrative and compliance tasks related to employment.

Due to their different responsibilities, in co-employment, the client company is sometimes known as the ‘operational employer’ or ‘worksite employer.’ In contrast, the PEO is the ‘legal or ‘administrative employer.’

As a legal employer, the PEO usually becomes responsible for:

- Filing necessary employment documentation with the authorities such as state new hire reporting, worker’s comp claim administration, and unemployment claim responses.

- Withholding and filing employee income tax and payroll taxes such as FICA and FUTA/SUTA.

In turn, the client company remains responsible for:

- Making hiring and firing decisions.

- Determining employee salaries and bonus payments.

- Directing staff in their duties.

- Health and safety in the workplace.

- Ensuring Equal Opportunity in Employment (EEO).

- Communicating with the PEO to ensure that administrative and compliance duties are fulfilled.

Note that the IRS observes that in the US, client companies can still be legally liable for employee taxes despite what is said in any PEO agreement. The IRS does not recognize the concept of ‘co-employment’ in its Tax Code and may find the client company liable as the “common law employer.”

The way to mitigate this legal liability is for a client company to engage a CPEO — as discussed earlier in this article.

The PEO charges the business a fee for its services in exchange for the responsibilities and liabilities it takes on. The fee amount depends on factors such as the number of employees, the type of HR services provided, and the company’s chosen fee model.

The most common charging models are:

- A flat fee per month per employee.

- A percentage of gross payroll.

Why choose a PEO?

The alternative to using a PEO is to carry out the standard payroll and HR functions in-house. So why pass this to a third party? There are pros and cons to engaging a PEO that must be weighed before committing to this option. We consider these below. In short, companies interested in PEO solutions need to consider:

- How much more does hiring and paying internal employees for these tasks cost?

- What are the risks of performing the task internally versus outsourcing it?

- Would other outsourcing solutions, such as payroll outsourcing, temp agencies, or staffing agencies, be a better option?

- Once the decision has been made to move to a PEO, which PEO should be selected?

The National Association of Professional Employer Organizations (NAPEO) — why you need a PEO

Advantages of using a PEO?

1. PEOs are HR and payroll specialists

PEOs have the knowledge, infrastructure (such as specialist PEO cloud platforms), and experience that many businesses (especially smaller businesses) don’t have. This means fewer payroll and HR errors. These errors are not only a compliance risk, which can result in penalties or fines, they are a surefire way to alienate your workforce.

2. PEOs can access better deals on benefits

Through economies of scale (PEOs serve many client companies, with employees often having similar benefits), a PEO can often access more competitively priced health insurance plans than those that would otherwise be available to the client company’s employees.

3. Compliance assurance

PEOs are familiar with applicable labor and tax laws, and any recent changes. It is difficult for all but the largest companies to have HR and payroll teams whose familiarity with legal requirements will rival that of a PEO.

4. Add-on services

PEOs may often provide a range of other services that can benefit client companies. These services may or may not be included in the standard PEO fee. These add-on services include:

- Recruitment.

- Background checks and drug testing.

- Visa, work permit, and relocation assistance.

- Employee relations, employee handbooks, and dispute management.

- Workforce training (e.g. cyber security, harassment-free workplace, etc.).

- Handling workers’ compensation and unemployment insurance claims.

- Administration of Retirement Plans.

- Administration of Employee Assistance Programs.

While these additional services could be achieved by the client company using other providers (such as a recruitment agency), time and transaction costs are saved by taking advantage of the existing relationship with the PEO.

5. Cost savings

In many cases, it is cheaper to engage a PEO to provide payroll and HR functions than for a company to carry it out themselves. One analysis based on US Small Business Administration (SBA) figures, reported that businesses save 40 percent by outsourcing these tasks to a PEO.

According to a 2019 report from the National Association of Professional Employer Associations (NAPEO), a conservative estimate of the return on investment (ROI) of engaging a PEO is 27.2 percent.

What are the disadvantages of using a PEO?

Are there any downsides to engaging a PEO? This depends somewhat on the goals of the client company and the particular services offered by a chosen PEO. However, some potential downsides that have been reported include:

1. The loss of some control over HR functions and processes

When you engage a PEO to carry out HR and payroll tasks, you are essentially giving up some control over these important functions. This can be psychologically difficult for business owners who like to be in the driver’s seat when it comes to their company.

But it also carries an element of risk: For example, unresolved payroll errors may well have a major impact on staff turnover, yet the client company may have inadequate levers to immediately fix the issue.

The possibility is that the PEO might not be able to provide the same level of service as an in-house HR department. For this reason, it is crucial that companies choose a PEO with an excellent reputation for customer support.

2. The potential for increased costs if the PEO does not deliver on its promises

If a PEO does not deliver, it can end up costing the company more money in the long run. If there are an excessive number of payroll errors, or employees are unhappy with the service, the company may need to end the engagement. This means either starting up payroll and HR functions to match what the PEO provided or finding another PEO.

Any termination fees in the contract, plus the transaction costs of closing one engagement and starting a new one can quickly add up.

3. Limited choice in employee benefits

As mentioned, a PEO can often source more competitive benefits, such as health plans, than can be sourced by companies individually. However, it is also likely that they may have relatively ‘standardized’ benefits packages. This may end up giving your workforce less than they would otherwise receive.

4. Data compliance risk

PEOs deal with employee personal data: This means there is a risk of data breach or non-compliance under laws such as the General Data Protection Regulation (GDPR) or the CCPA. Whether or not this results in liability for the client company depends on the breach and the data processing agreement in place between the client company and the PEO.

Overcoming the potential PEO downsides

Are there ways to overcome these disadvantages? Yes, ultimately it is a matter of choosing the right PEO. A reputable PEO will have in place:

- Systems to quickly respond to and deal with errors, so that the loss of payroll/HR control is less problematic.

- A reputation for excellence which means that the contract is unlikely to go awry.

- Employee benefits that are genuinely competitive in both quality and price.

- A level of service that exceeds that which would be provided by your own staff.

- Compliance management systems reduce the risk of data breaches and can quickly manage a breach.

What are the alternatives to using a PEO?

Are you considering a professional employer organization (PEO) but not sure if it’s the right fit for your business? PEOs are not right for every business. Consider below some of the key alternatives.

1. ASO

ASO stands for ‘Administrative Services Only‘. An ASO firm can take over administration for your employee health plans, but they do not have full responsibility for managing plans, such as dealing with claims. Only a PEO or Employer of Record can take over full responsibility for that task.

Sometimes the term ASO is used to refer to ‘Administrative Services Outsourcing’, which means outsourcing administrative tasks generally, not just health plans. Firms that fulfill this task might take care of health insurance matters, pension contributions, workers’ compensation premiums, and more.

If you’re considering an ASO, take a look at our blog post comparing ASOs and PEOs.

2. HRO

Human resource outsourcing (HRO) is similar to using a PEO in that it allows you to outsource your HR functions to another company. However, a key difference is that HRO providers typically don’t assume co-employment or EOR responsibilities for a company’s employees as a PEO does. Think of HRO as an extension of your existing HR staff.

This means that HRO providers usually can’t offer certain employee benefits like health insurance or workers’ compensation coverage, nor withhold and file taxes on behalf of your workforce.

However, with a more streamlined service offering, HRO services are usually less expensive than a ‘full PEO’.

Read more at HRO vs PEO: What’s the Difference?

3. Payroll Company/Payroll outsourcing

With payroll outsourcing, you outsource your entire payroll function—including data entry, tax filing, and check processing. This can save you money on payroll processing costs.

However, there are some potential drawbacks to using payroll outsourcing services as well— as with HRO, the service is limited and the payroll company will not be able to provide certain benefits or manage taxes on your behalf (unless they are also registered with the IRS as a third party payer). That requires co-employment of the sort provided by PEOs.

Examples of top-rated PEO companies

There are many reputable PEO companies out there, so it’s important to do your research to find the one that’s the best fit for your business. A few top-rated PEO companies include:

- G&A Partners. G&A Partners offers a full suite of HR solutions, including ASO, HRO and PEO. It also goes beyond the offerings of many providers with Recruitment Process and Accounting outsourcing as well.

- TriNet. Trinet integrates its own HR platform into its PEO and HR offerings and is focused on the SME market Since 1995 it has been accredited by the Employer Services Assurance Corporation (ESAC). Read more about this PEO and HR solution in our 2023 TriNet service breakdown and analysis.

- Insperity. Insperity is a full-service PEO and HR company, serving businesses of all sizes. It has a special focus on the customer experience. For more information, see our 2023 Insperity review.

- Justworks is a newer PEO with a state-of-the-art platform sporting comprehensive employee management tools, such as time-tracking.

- ADP is arguably the most established company in the industry, existing for over 70 years. It offers a comprehensive range of payroll, PEO, and HR solutions. Read more about the ADP PEO solution in our 2023 review.

PEO — the right solution for your business?

A Professional Employer Organization, or PEO, is a comprehensive HR and payroll solution. A PEO not only takes care of payroll, payroll taxes, benefits, and HR compliance support, but they serve as a co-employer of your workforce.

The benefits of PEOs can be substantial: They can save businesses (especially SMEs) time and money while providing employees with better benefits. Any potential risks in engaging a PEO are best mitigated by a robust PEO agreement, and choosing a reputable PEO.

To find out more about which PEO might suit your company, check out our top 10 PEO guide.

Frequently Asked Questions

PEO stands for Professional Employer Organization. A PEO is a company that carries out HR and payroll functions on behalf of client companies.

PEOs can offer a number of advantages to businesses, including:

- Saving time and money on payroll processing, benefits and tax administration and HR

- Access to employee benefits that the company might not be able to provide on its own

- Compliance assistance with employment and tax laws and regulations

A PEO does usually provide payroll processing services, However, a PEO is much more than just a payroll company: In addition to handling payroll, PEOs can also provide access to employee benefits, compliance assistance, and other HR services.

PEOs are a great solution for small and medium-sized businesses that don't have the resources to handle all of their payroll and HR needs in-house. A payroll company, on the other hand, is often better for larger companies that already have a significant HR function in place.

A staffing company provides temporary or contract workers to businesses. If the worker is to become a fulltime employee they are usually hired directly by the client company.

A PEO, on the other hand, provides payroll, HR and compliance services to client companies and becomes the 'Employer of Record' for employees. The worker does not become a permanent employee of the client company.

Read more at PEO vs Staffing Company.

Yes, PEOs can provide assistance with benefits administration and health insurance. In addition to providing access to employee benefits, PEOs can also help with compliance, payroll, and other HR functions.

Yes, many PEOs offer services to assist with employee performance management, including the development of performance appraisal systems and strategies to improve employee productivity.

The National Association of Professional Employer Organizations (NAPEO) is a national organization based in the United States that represents the interests of Professional Employer Organizations (PEOs). PEOs are firms that provide comprehensive HR solutions for small and mid-sized businesses (SMBs), helping them streamline their HR management by offering services such as payroll processing, benefits administration, regulatory compliance assistance, and more.

NAPEO serves as an advocacy group, seeking to voice the concerns and interests of PEOs at both the state and federal levels. Apart from advocacy, NAPEO also provides a platform for PEOs to network, collaborate, and educate themselves on industry best practices. They work towards facilitating a favorable legislative and regulatory environment for the PEO industry to thrive in, fostering the growth and success of PEO businesses.

It hosts educational events, webinars, and conferences offering industry insights and the latest updates pertinent to PEOs. Furthermore, it produces research reports and other resources to support PEOs in their operations. NAPEO is an essential hub for PEO professionals, helping them navigate the complexities of the industry and stay abreast of trends and developments. It essentially works to foster the growth and innovation of the PEO industry in the US, promoting standards of excellence and ethical conduct among its member organizations. It is advisable to check the latest resources for the most recent updates regarding the role and initiatives of NAPEO as the information might change over time.

Yes, you can use a Professional Employer Organization (PEO) for just one employee. Many PEOs offer services to small businesses and startups with a minimal number of employees, including those with only one employee. Engaging a PEO for a single employee can still provide you with a range of benefits such as handling payroll, tax administration, and providing access to better health and benefits packages than a small business might be able to secure independently.

However, it's essential to note that different PEOs might have different minimum requirements, and while many are willing to work with very small businesses, others may cater primarily to organizations of a certain size. It is advisable to research and reach out to various PEOs to understand their offerings and whether they can accommodate a business with one employee.

Moreover, while utilizing PEO services for a single employee, it would be beneficial to analyze the cost-effectiveness of this approach, as the fees for PEO services might be substantial for a business with a very small number of employees. It is always a prudent strategy to carefully review any contractual obligations and the range of services provided to ensure alignment with your business needs and budget constraints.